By Aaior K. Comfort

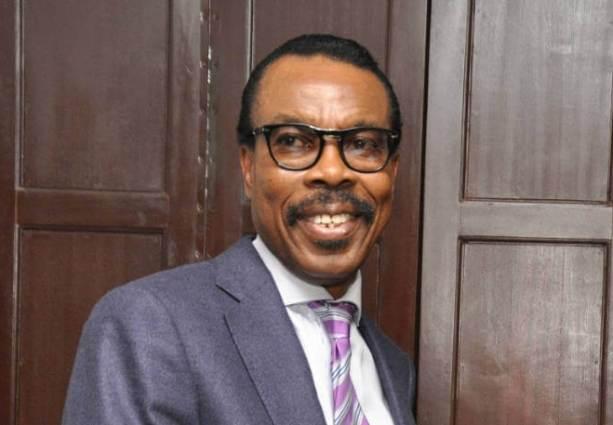

Bismarck Rewane, Managing Director and CEO of Financial Derivatives Company Limited, has projected that Nigeria’s economy will grow by 3.5% by 2026, potentially raising the country’s GDP to around $400 billion. He shared this forecast at the Access Bank Customer Forum in Lagos.

Rewane noted that Nigeria is on track to become the second-largest economy in sub-Saharan Africa, emphasizing improvements in the foreign exchange auction system and a rise in unencumbered foreign reserves to $20 billion.

He forecasted a decline in inflation to 22% by 2026, with the monetary policy rate likely dropping to 20%. This change is expected to reduce bad loans across the banking sector. However, he cautioned that the naira may trade at N1,550 to the dollar in the parallel market, influenced by intervention funds, diaspora remittances, and exchange rate policies.

Rewane anticipated total factor productivity would increase to 2.6% by 2026 and the trade balance would improve to $9.3 billion. He also predicted that petrol prices would stabilize at N900 per liter, supported by production from the Dangote refinery and modular refineries.

In terms of commodity prices, he projected that a basket of tomatoes would cost N20,000, a bag of rice N75,000, and a bag of beans N110,000 by 2026. Despite these positive projections, Rewane highlighted inflation as a significant challenge affecting operating margins for Nigerian companies.

Minister of Finance and Coordinating Minister of the Economy, Edun, reported a net inflow of approximately $2.35 billion into the Central Bank over the first seven months of the year, contributing to naira stabilization in the forex market. He noted the need for increased infrastructure spending to improve Nigeria’s tax-to-GDP ratio, which stands at 10%.

Taiwo Oyedele, Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, expressed caution regarding Rewane’s optimistic outlook, citing challenges such as divestment, poor education, and rising unemployment. He emphasized the importance of data-driven decision-making to support economic growth and highlighted plans to reduce company income tax in future years to ease the burden on businesses while improving revenue collection efficiency.