The Joint Revenue Board (JRB), formerly known as the Joint Tax Board (JTB), has placed a nationwide ban on the collection of road taxes, levies and related charges through checkpoints, including the use of road stickers by state and non-state actors, as part of efforts to sanitise Nigeria’s tax administration and improve the ease of doing business.

The decision was contained in a communiqué issued at the end of the 158th meeting of the Board held recently at the Transcorp Hilton, Abuja.

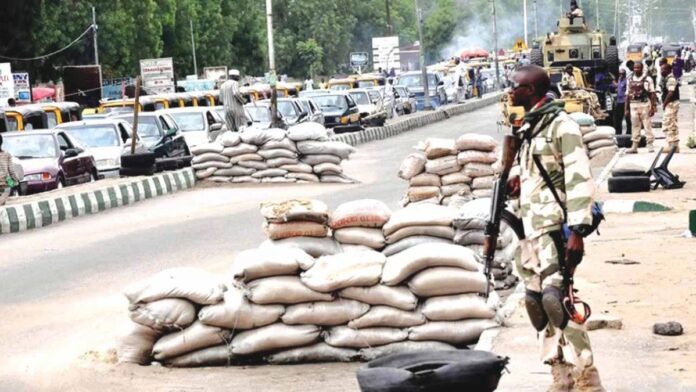

At the meeting, the JRB vowed to stop non-state actors from participating in the revenue administration value chain and called on the Office of the National Security Adviser, the Nigeria Police Force and other security agencies to take immediate action against illegal roadblocks mounted along major transport corridors for the purpose of collecting taxes, levies, rates and charges.

The abolition of road taxes comes against the backdrop of new tax reforms being pushed by the Bola Tinubu administration through four new tax laws to be implemented from January next year.

According to the Board, such practices undermine the integrity of Nigeria’s tax system, impose arbitrary costs on businesses and transporters, and weaken confidence in sub-national revenue administration.

“The Board re-emphasises the outright abolition of the design, production, issuance and enforcement of all manner of road stickers and related instruments by both state and non-state actors,” the communiqué read in part.

It urged Nigerians to resist the payment of such levies and to report individuals or groups involved in their issuance to relevant security agencies for appropriate sanctions.

Beyond the ban on road taxes, the JRB called on state governments to fast-track the passage of the Harmonised Taxes and Levies (Approved List for Collection) Bill into law to ensure uniformity in the application of taxes, rates and levies at the sub-national level.

The Board noted that harmonisation would reduce multiple taxation, enhance compliance and align state-level revenue practices with the objectives of ongoing national tax reforms.

The meeting, held under the theme “Managing Transition: Driving Transformation, Building the Future of Tax Administration in Nigeria,” also reviewed the implications of the transition from the Joint Tax Board to the Joint Revenue Board.

The JRB described the transition as a critical step towards a more coordinated and efficient national revenue administration framework, with improved collaboration, data sharing and the use of analytics to strengthen tax compliance across the federation.