By Abdul Lawal, Abuja

The Federal Government is set to spend N3.3trillion on first half year 2023 while non-oil revenue will account for 80 per cent of the revenue needed to finance the budget.

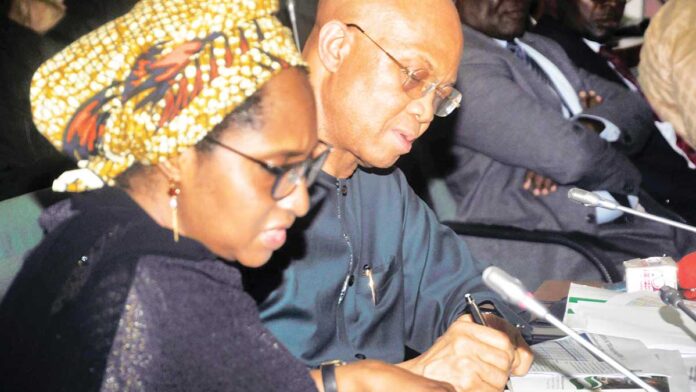

The Minister of Finance Budget and National Planning Dr Zainab Shamsuna Ahmed made the disclosure on Thursday during the 2023 budget breakdown meeting tagged “Budget of Fiscal Consolidation and Transition” in Abuja.

The Minister of Finance said the IMF had projected that economic growth would decline globally from 6.0 per cent in 2021 to 2.7 per cent in 2023, due to the COVID-19 pandemic, rising cost of food and fuel driven by the war between Russia and Ukraine.

According to her, the 2023 budget was prepared against the backdrop of those challenges listed above.

Dr. Ahmed however projected that the nation’s economy would grow by 3.75 per cent and inflation at 17.16 per cent, and that they would be driven by activities during the next elections.

Other benchmarks include; crude oil price at $70 as against $73 in 2022 and crude production at 1.69 million barrels per day.

On the fuel subsidy, she said N3.36trillion had been set aside for that and would run till mid 2023.

She listed the critical allocations in the 2023 budget to include, Defence, Education and the Health sectors having the lion share of N6.37trilion representing 31 per cent of 2023 budget.

Recall that President Buhari had presented a total amount of N20.51trillion to the National Assembly recently as the 2023 proposed budget.

The Minister made the disclosure while making her speech at the 2023 Budget Presentation held in Abuja on Wednesday.

Breaking down the figures the Minister said, “Defence and Security Sector is allocated N2.74 trillion representing 13percent of the Budget. This amount is provision for the Military, Police, Intelligence & ParaMilitary (Recurrent & Capital expenditure).

Dr. Ahmed also gave a breakdown of the total revenue of N9.73 trillion and emphasized that it would be driven by the non-oil sector (80 per cent) while the oil sector accounts for 20 per cent.

She stated that the budget had a deficit of N10.78 trillion, which is 4.78 per cent of the GDP and would be funded by domestic and multilateral borrowings and proceeds from privatisation.

On the debt profile, the Minister said it currently stood at $102 billion, comprising 35 per cent foreign debt and 65 per cent domestic.

The Minister allayed the fears of the citizens, and gave an assurance that the nation’s debt was still within limit that is 23 per cent of the country’s gross domestic product.

Giving the breakdown of the budget in critical sectors, Dr. Ahmed said education got 10 per cent that is N2.05 trillion including N300 billion for university revitalisation and N170 billion for upward adjustments of salaries for university lecturers.

Others include Health N1.58 trillion, Defense and Security got N2.74 trillion, Infrastructure received N998.9 billion while Social Development and Poverty Reduction was allocated N756 billion.

She pointed out that crude production challenges and PMS subsidy continue to threaten revenue growth targets but efforts were on to enhance revenue collection, to bring the informal sector into the tax net and improve the ease of doing business.

Dr. Ahmed stressed the need to urgently address revenue underperformance and expenditure efficiency at national and sub-national levels and urged civil society organizations and other relevant stakeholders to enhance the budget implementation through monitoring.

“Also N248.27billion amount allocated for Transfers to the Tertiary Education Trust Fund (TETFUND) for infrastructure projects in Tertiary institutions while N95.30 billion is amount provisioned for Universal Basic Education Commission (UBEC).”

In the health sector the Minister stressed that a total of N1.58 trillion which represented 8 per cent was allocated in the 2023 budget.

She said N1.41 trillion was the amount made as provision for Federal Ministry of Health and its agencies (Recurrent & Capital expenditure, including Hazard Allowance), while N69.57 billion Gavi/ Immunization funds, including Counterpart Funding for Donor Supported Programmes, including Global Fund and also N47.65 billion for Transfer to Basic Healthcare Provision Fund (BHCPF).

Other sectors like Infrastructure got N998.93 billion, 5 per cent of Budget which includes provisions for Works & Housing, Power, Transport, Water Resources, Aviation.

“Social Development & Poverty Reduction Programmes got N756 billion representing 4 per cent of Budget amount as provision for Social Investments / Poverty Reduction.”

The Minister stated that the total Public Debt as a percentage of GDP stood at 23.06 per cent as at June 30, 2022, within 55 per cent threshold recommended by the International Monetary Fund (IMF) / World Bank (WB), as well as Nigeria’s selfimposed limit of 40 per cent set in the MTDS 2020-2023 even after including the outstanding balance on CBNWays & Means Advances.

She said, “The exposure of the Total Public Debt portfolio to exchange rate risk remains moderate, as the share of Domestic Debt in the Total Public Debt comprises 60 per cent. Target Ratio under the MTDS 2020-2023 is 70:30, with the DMO expecting to achieve the target by end of the year 2023.

“The exposure to refinancing risk remained stable as a result of the strategy of issuance of long dated securities in the domestic and international markets in addition to accessing long term funds from multilateral and bilateral lenders.”

According to the Minister, the draft 2023 budget has been prepared against the backdrop of continuing global challenges occasioned by lingering COVID-19 pandemic effects, as well as higher food and fuel prices due to the war in Ukraine.

She noted that overall, fiscal risks are somewhat elevated, following weaker-than-expected domestic economic performance and structural issues in the domestic economy.

Dr. Ahmed said, “Early passage of the Budget for implementation from January 1, 2023 will significantly contribute towards completion of key legacy projects, smooth transition and achievement of government macro-fiscal and sectoral objectives.

“Revenue generation remains the major fiscal constraint of the Federation. The systemic resource mobilization problem has been compounded by recent economic recessions as efforts will however be focus on improving tax administration and collection efficiency.”